Dūrā Should I invest in bitcoin/BTC? I am being asked this question very often these days, and as always I find easier to write a blog post when I see myself repeating the same opinions. And I still believe that “If you don’t have strong opinions, you do not have an opinion.” But first a little bit of history.

Amazon is losing money

Some twenty years ago, I was having a conversation about personal investing with a banker colleague – a very experienced and successful capital markets executive. He had very strong opinions about how to invest personal money – essentially “value investing” in the Warren Buffet style, focusing on fundamentals. During our chat, I mentioned the recent IPO of a company named Amazon, and how I thought that it was a great investment – and listened to a long explanation about how Amazon will disappear soon: it makes no profit, and there is no mass market of people who want to buy a book before browsing it first.

Few investors could have foreseen that AMZN would gain about 50,000% in the two decades after its initial public offering. One thousand dollars invested at the closing price on Amazon’s IPO day in 1997 would be worth over $500,000 today.

Facebook is for teenagers

Eight years ago, I was fascinated by the “new” social media. See my early posts here and here. I believed that “social” was the innovation that will “change the world”, from news to personal interactions to a new potential collaboration paradigm in the workplace. With my long track of being “too early”, I tried to promote the idea of a social app for the workplace to my bosses at IBM, just to be shut down at the almost-top by an experienced executive that was of the strong opinion that Facebook is an app for partying teenagers. (Soon after IBM moved into that space, proving that a strong innovation culture cannot be shut down by the uninformed opinion of the highest paid person in the room).

Today Facebook and Amazon both have markets caps of over half a trillion. FB is a computer program. AMZN still doesn’t make any money. Half a trillion.

Bitcoin and Blockchain

These days I am being asked weekly about my opinions on bitcoin and blockchain. I have been a fintech investor for a while, investing in startups that are attempting to disrupt or merely change the way financial services are delivered and consumed. Some of those startups are using blockchain technology, the distributed ledger innovation that is the underpinning for the issuing and transaction processing of the cryptocurrency named bitcoin. Three years ago, I stated in public interview that it was “too early” for VCs to invest in the space. We are now in late 2017 and of the over 24,000 cryptocurrency startups in the world, less than 800 are still operating. I have spent social time and due diligence time with several of them. While many of them have great ideas, and all have fantastic teams, now is the time to have strong opinions and invest in the few ones that have a good chance to succeed.

Is Bitcoin an investment?

Which brings me to the reason so many people ask me about bitcoin these days. It has to do with buying bitcoin for profit, using fiat money “real dollars” to “invest” in bitcoins. Big bank executives slam bitcoin as a scam, a Ponzi scheme – from Goldman Sachs in New York to DBS in Singapore. The BTC/USD price chart is what gets everyone excited – or scared.

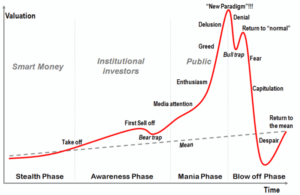

My advice to all my friends is to think about bitcoin in terms of asset allocation and risk for their personal financial situation. 5% to 10% of a personal portfolio invested in fun investments is OK. But allocating 100% to bitcoin is not investment, it’s speculation. And investing without understanding the fundamentals, focusing only on price, and listening to the increasingly frenetic chat has all the markings of a disaster waiting to happen. Sure, some people made (lots of) money buying and holding bitcoins. Forget that the true transformational value of cryptocurrency is to facilitate cheap, secure, no-central-trust/distributed transactions, i.e. bitcoins are used as an exchange mechanism for real-life transactions. It so much reminds me of 2008 and the belief that we can all get rich by buying houses from each other. Now we buy bitcoins from each other at increasingly higher prices. There is another chart that I advise all my bitcoin enthusiastic friends to study and guess where on this chart have they bought or intend to buy.

What’s your guess? Do you have a strong opinion?